Fruitiion, Inc.

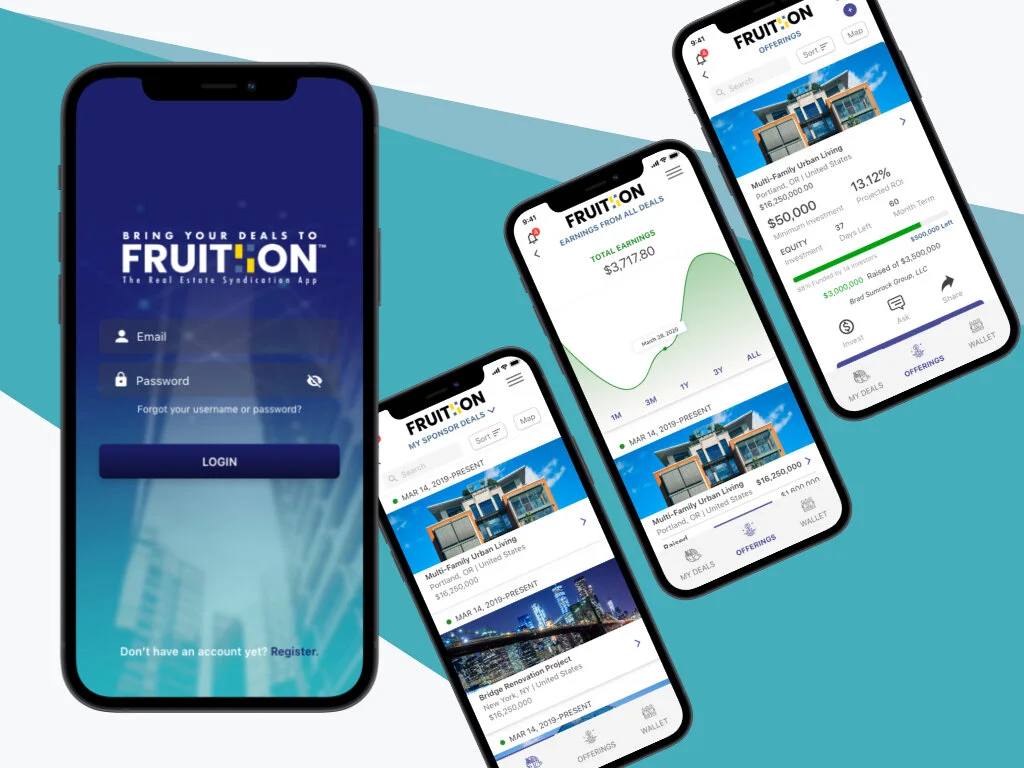

Fruitiion is an SEC-accredited real estate syndication mobile app, which organizes the capital of investors and sponsors, manages ownerships fees, and automates distributions in one application. It aims to have a simple and minimalistic design with an emphasis on usability and functionality to gain the trust of individuals with high capital holdings.

Project

Date

December 2017 to December 2020

David Corrales (company COO) approached me to be the lead software designer for a mobile real estate syndication app with a heavy emphasis on analysis of competitive & qualitative data to produce a design that gained the trust of target users and stood out against competing softwares.

ROLE

Freelance UI/UX Designer

I drove design strategy and execution within my scope, functioning as the lead designer and guiding the project from research through delivery.

Team

4 Junior Designers — 2 focused on the Android Flutter app and 2 on the iOS Native Swift application.

Responsibilities

Conducted user and competitive research to inform design direction

Created journey maps, wireframes, and interactive prototypes

Led user testing sessions to validate design concepts and improve usability

Developed visual design systems and refined UI patterns for consistency across platforms

Collaborated with junior designers to ensure cohesive outcomes and alignment with user needs

Tools

Adobe XD, Sketch, InVision Studio, Material Design System Guidelines, Firebase Analytics

Summary

My goal was to create software that simplified the customarily convoluted task of organizing the capital of investors and sponsors, managing ownerships fees, and automating distributions. It had to be perceived as trustworthy. A significant part of the process was analyzing competitive and qualitative data via focus groups as well as perception control with use of design elements such as color, typography, layout, and other elements based on Material Design System guidelines to produce a coherent and competitive product. The latest iteration of the product was ultimately minimalistic and pleasing to the eye yet elegant to use. The results were successful according to focus groups including target audience members above 45 years of age. It was deemed trustworthy, successful at simplifying previously complex tasks in real estate capital management, and perceived as a strong competitor amongst other products currently in the market.

Visual Mock-Ups

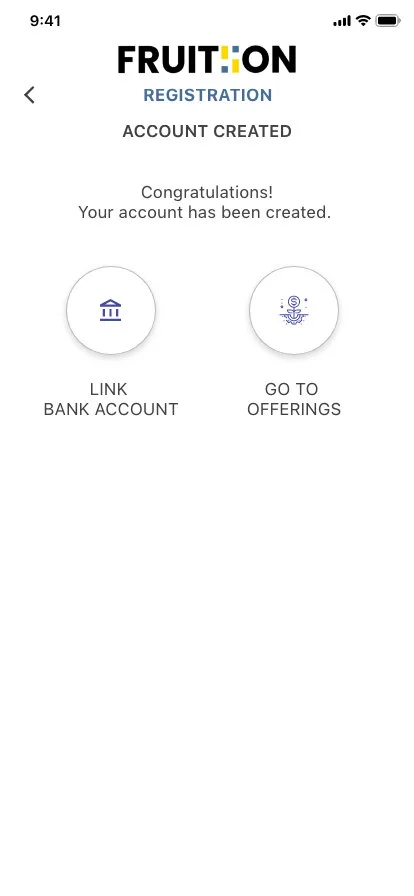

Getting Started

Deals (Sponsor View)

Deals (Investor View)

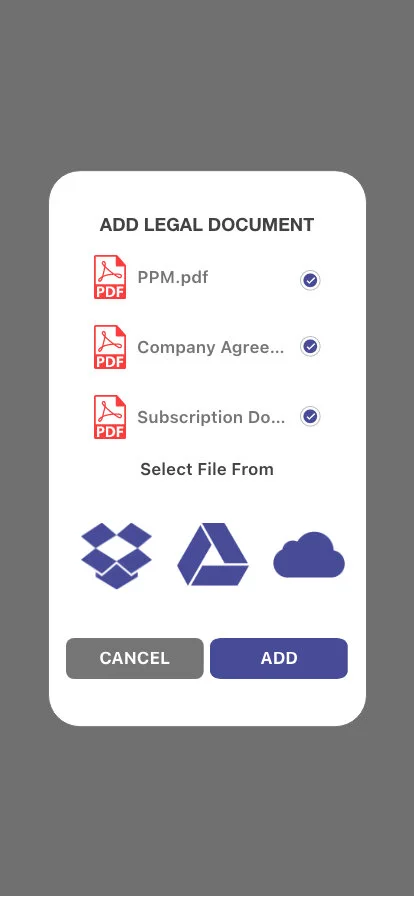

Deals (Closing)

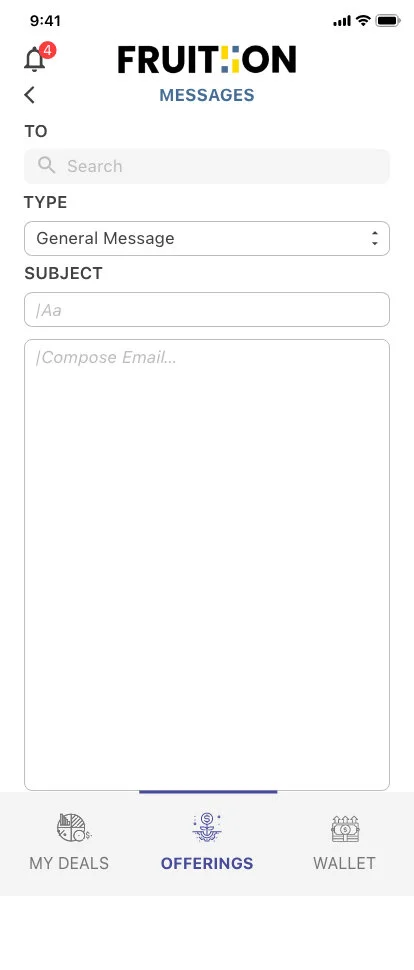

Account & Messages

Distributions & Equity Ownership

High-Fidelity

Prototype

The Challenge

Create an app that appeals to the target audience, fulfills user and conceptualized needs and goals, and stands out from the competition.

Target Audience

Accredited investors ($1 million net worth)

Sophisticated investors ($300K salary)

Likely middle-aged or older

Likely white (may include Asian and Indian)

With a college education or higher

Reference: Boshara, R., Emmons, W. R., & Noeth, B. J. (2015, February). The Demographics of Wealth: How Age, Education and Race Separate Thrivers from Strugglers in Today’s Economy. Retrieved December 28, 2017, from https://www.stlouisfed.org/~/media/files/pdfs/hfs/essays/hfs-essay-1-2015-race-ethnicity-and-wealth.pdf

Personality & Attitudes

Responsible

Hardworking

Assertive

Prolific

Proactive

Confident

Busy

Risk tolerant, but discerning

Values

Free market

Social mobility

Opportunities of growth

Security

Expansion of relationships and networks

Effective use of time

Productivity

Limitations on government regulations

Lifestyle & Interests

Boating

Travel

Golf

Art

Politics

Philantrophy

Client Needs

An attractive, smooth, and intuitive application that appeals to target users

An application that gains the trust of target users through design choices and minimal occurrence of bugs or errors within the app

To generate profit and high return on investment for shareholders and owners

To stand out from competitors

Data analytics to track characteristics and behaviors and error reporting of users to allow refinement of future iterations

User Needs

Legible and intuitive software

Secure and reliable application handling large sums of capital

Eliminate extra cost of fees associated with use of automated clearing house

Decreased cost of transactions and increase capital

Accredited software to manage capital and investments

Transparency and direct communication between investors and sponsors

Get automated updates for investments

Ability to choose individual potential assets created by individual sponsors

Competition

Fundrise

Fundrise is an online real estate investment trust (REITs) that allows investors to buy into properties by pooling their assets through this investment platform. It offers eFunds, in which investors’ pooled money is used to buy land, develop housing, and then sell it to home buyers.

Pros: Low minimum investments, open to all investors, easy-to-use website.

Cons: Fees are difficult to understand, investment are highly illiquid, complex investments requiring due dilligence, no mobile application

Crowdstreet

CrowdStreet is a platform that pairs individual investors with project developers. Users can pick individual properties or buy into CrowdStreet’s funds, which consist of a diverse real estate projects.

Pros: Access to commercial deals, high return potential, easy-to-use website

Cons: Steep minimum investments, investments are highly illiquid, available only to accredited investors, no mobile application

RealtyMogul

RealtyMogul is an online real estate investment platform that allows nonaccredited (who have access to two public nontraded REITs) and accredited investors (who have access to private investment in addition to REITs) to invest in commercial deals.

Pros: REIT products are open to nonaccredited investors, REIT buyback program increases liquidity, high targeted rates of return

Cons: High minimums, complex fee structures, short track record, no mobile application

Juniper Square

Juniper Square is an all-in-one web-based platform for commercial real estate investment managers and their individual investors. It streamlines fundraising with real-time access to data and includes Client Relationship Management (CRM).

Pros: easy-to-use website, good customer support, eases communication between investors and managers

Cons: no mobile application, lack of customization of fund structures and web layouts

“It’s the only app-based sponsor driven deal platform. In Fruitiion, you can pick and choose individual deals created by individual sponsors. Competitors such as Fundrise and Realty Mogul, pre-select deals that you can then invest into.

Fruitiion is sort of like the Free-Market which also allows

Investors to deal directly with the Sponsor.”

-David Corrales (Fruitiion COO)

The Conception

An idea come to life.

Process

1.

Ideation

2.

Research and Development.

3.

Mapping and Wireframing.

4.

Visual Mock-Ups.

5.

High-Fidelity Prototyping.

6.

Iterations and Refinement.

Ideation

Meetings with owner and stakeholders on:

Conceptualization which included on opportunities and limitations of a mobile app a real estate syndication platform

Strategy which included delineation of the target audience characteristics, user needs, and client needs (as outlined above)

Outline of scope which included delineation of content requirements and functionality requirements

Identification of goals and targeted outcomes

Fruitiion, Inc. was chosen as the name of the application. According to Oxford Languages, the word fruition is “the point at which a plan or project is realized,” or “the state or action of producing fruit.” We decided to use the double “ii” in the name to visually represent the relationship between the investor and sponsor or the user and the application. Altogether, we wanted the name to suggest to the user that these symbiotic relationships would be “fruitful” and mutually beneficial to all parties involved.

“God said unto them, Be fruitful, and multiply, and replenish the earth, and subdue it: and have dominion over the fish of the sea, and over the fowl of the air, and over every living thing that moveth upon the earth.”

Research & Development

Research was undertaken on:

similar real estate investment software using SWOT Analysis

targeted users

Focus Groups (8-12 People per meeting)

Most thought investing through an app was too hard as font might be too small

Most didn’t think it was possible

Most didn’t trust transferring large sums of money via phone

user needs assessment

available third-party plug-ins that can be used to streamline capital transfers

tools for further user testing in later phases of development

The ideas and goals were refined based on the research findings

The main functions were identified.

Provide a platform that will automate distributions with instant redistribution/allocation to investors.

Organize user equity in each investment.

Allow tracking of all investments in one software.

Provide a platform to advertise real estate deals to accredited and sophisticated investors.

Provide a messaging platform to allow direct communication between investors and sponsors.

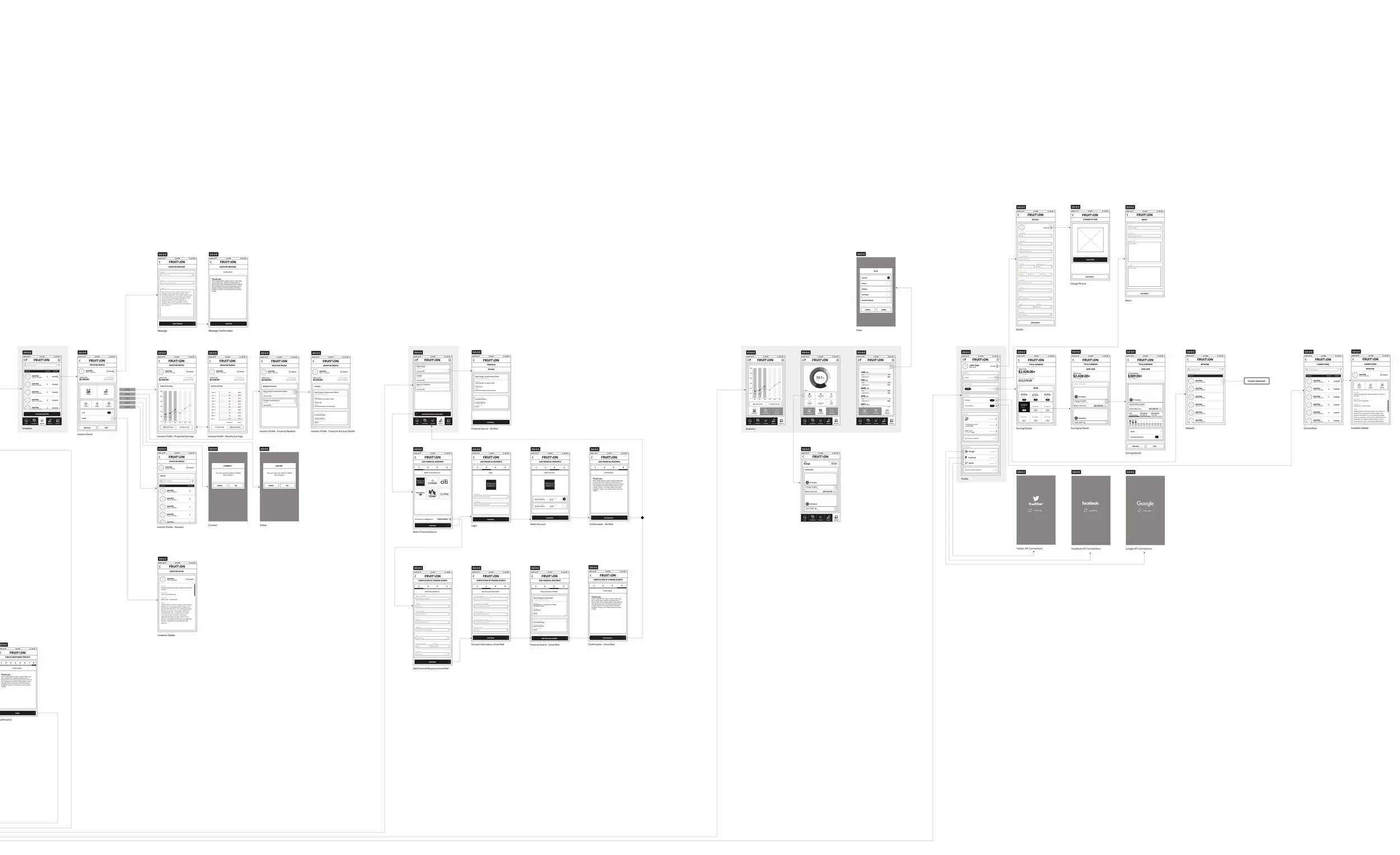

Mapping/Wireframing

Based on research and development findings and resolutions, wireframes were created. Each set of wireframes were resent to owners, stakeholders, and focus groups. Wireframe iterations were made and resent. This process was repeated 5-6 times before visual designing was begun.

For a closer look, access the PDF file below:

Results

The next phase includes further iterations and refinements. Some of the successes, thus far, include having locked in a few partners, reception of recognition from CCIM, and a successful preliminary design of a FinTech start-up. Lessons learned include the importance of focus groups and qualitative analysis for software development and opportunities include increasing amount of actual user research before sending the final designs to coders for programming.